Table of Contents

Everything you need to know to understand Share Vesting.

Looking to implement share vesting in your business? You’ll be needing a Share Vesting Agreement and here’s a step-by-step guide to vest shares to an employee or consultant.

Looking to implement share vesting in your business? You’ll be needing a Share Vesting Agreement and here’s a step-by-step guide to vest shares to an employee or consultant.

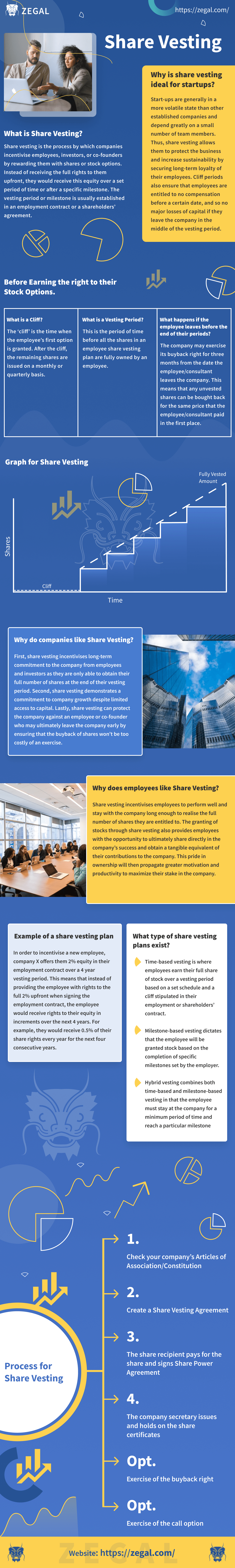

Infographic content:

What is share vesting?

Share vesting is the process by which companies incentivize employees, investors, or co-founders by rewarding them with shares or stock options. Instead of receiving the full rights to them upfront, they would receive this equity over a set period of time or after a specific milestone. The vesting period or milestone is usually established in an employment contract or a shareholders’ agreement.

Why do companies like it?

First, share vesting incentivizes long-term commitment to the company from employees and investors as they are only able to obtain their full number of shares at the end of their vesting period. Second, share vesting demonstrates a commitment to company growth despite limited access to capital. Lastly, share vesting can protect the company against an employee or co-founder who may ultimately leave the company early by ensuring that the buyback of shares won’t be too costly of an exercise.

Why do employees like share vesting?

Share vesting incentivizes employees to perform well and stay with the company long enough to realize the full number of shares they are entitled to. The granting of stocks through share vesting also provides employees with the opportunity to ultimately share directly in the company’s success and obtain a tangible equivalent of their contributions to the company. This pride in ownership will then propagate greater motivation and productivity to maximize their stake in the company.

Time-based vesting is where employees earn their full share of stock over a vesting period based on a set schedule and a cliff stipulated in their employment or shareholders’ contract.

What types of share vesting plans exist?

Milestone-based vesting dictates that the employee will be granted stock based on the completion of specific milestones set by the employer.

Hybrid vesting combines both time-based and milestone-based vesting in that the employee must stay at the company for a minimum period of time and reach a particular milestone before earning the right to their stock option.

Example of a share vesting plan

In order to incentivize a new employee, company X offers them 2% equity in their employment contract over a 4 year vesting period. This means that instead of providing the employee with rights to the full 2% upfront when signing the employment contract, the employee would receive rights to their equity in increments over the next 4 years. For example, they would receive 0.5% of their share rights every year for the next four consecutive years.

Why is it ideal for startups?

Start-ups are generally in a more volatile state than other established companies and depend greatly on a small number of team members. Thus, share vesting allows them to protect the business and increase sustainability by securing the long-term loyalty of their employees. Cliff periods also ensure that employees are entitled to no compensation before a certain date, and so no major losses of capital if they leave the company in the middle of the vesting period.

What is a cliff?

The ‘cliff’ is the time when the employee’s first option is granted. After the cliff, the remaining shares are issued on a monthly or quarterly basis.

What is a vesting period?

This is the period of time before all the shares in an employee share vesting plan are fully owned by an employee.

What happens if the employee leaves before the end of their vesting period?

The company may exercise its buyback right for three months from the date the employee/consultant leaves the company. This means that any unvested shares can be bought back for the same price that the employee/consultant paid in the first place.

Looking to implement share vesting in your business? You’ll be needing a Share Vesting Agreement and here’s a step-by-step guide to vest shares to an employee or consultant.