Table of Contents

Running a small business in Hong Kong or looking to start one there? Given that it is consistently ranked among the top in the world for economic competitiveness and has a straightforward business incorporation process that can be completed in five to seven days, Hong Kong is a popular destination for business owners.

Related reading: 5 reasons to set up your business in Hong Kong

These business benefits are not just limited to large MNCs and other big businesses. Small businesses also stand to benefit, what with a slew of resources and grants that the government provides for small businesses. Here, we identify the top 5 government grants for small businesses, so make sure you don’t miss out!

1. Level up your productivity & tech-savviness with the Innovation and Technology Fund (ITF)

In his 2017 Policy Address earlier this year, Chief Executive CY Leung announced that the government had invested $18 billion on measures to attract innovation and technology enterprises from Hong Kong and elsewhere. The Innovation and Technology Fund (ITF) ( one of the government business grants) that which is administered by the Innovation and Technology Commission introduces a range of support schemes to strengthen productivity and competitiveness among Hong Kong companies.

TF is a fund set up by the Government to support mainly applied R&D projects conducted by universities, industry support organisations, industry & trade associations or private sector companies which contribute to innovation and technology upgrading in industry in Hong Kong.

The following are the programmes and schemes under the ITF –

- Innovation and Technology Support Programme (ITSP)

- Guangdong-Hong Kong Technology Cooperation Funding Scheme (TCFS)

- Partnership Research Programme (PRP)

- Enterprise Support Scheme (ESS)

- Research and Development Cash Rebate Scheme (CRS)

- Midstream Research Programme for Universities (MRP)

- Public Sector Trial Scheme (PSTS)

- Technology Voucher Programme (TVP)

- Researcher Programme

- Postdoctoral Hub

- Reindustrialisation and Technology Training Programme (RTTP)

- Technology Start-up Support Scheme for Universities (TSSSU)

- The Innovation and Technology Venture Fund (ITVF)

- General Support Programme (GSP)

- Patent Application Grant (PAG)

Note:

- No application fee will be charged.

- single applicant can submit more than one application to the same programme/scheme under the ITF at any one time.

- funding scheme under the ITF has its specific funding criteria.

Related reading: The 6 Singapore Government Grants For Small Businesses You Need to Know

2. Connect with mentors and acquire resources for social enterprises with the SIE Fund

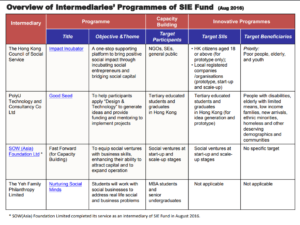

The Social Innovation and Entrepreneurship Development Fund (SIE Fund) provides resources to organisations that address poverty and social exclusion through innovative solutions. The government business grants -SIE Fund is allocated through a number of different intermediaries which administer programmes in the priority areas of Capacity Building and Innovative Programmes.

The SIE Fund has engaged The Hong Kong Council of Social Service, PolyU Technology and Consultancy Company Limited, SOW (Asia) Foundation Limited*, and The Yeh Family Philanthropy Limited as intermediaries to design and administer various programmes for the Fund’s priority areas of Capacity Building and Innovative Programmes.

-

Impact Incubator

Theme: Linking up social capital and helping social enterprises, organisations and social entrepreneurs develop business skills, identify opportunities and apply business approaches to address social needs.

Eligibility: NGOs, social enterprises, companies and Hong Kong citizens aged 18 and above are all welcome.

-

Good Seed

Theme: Helping you apply “Design & Technology” to generate idea; providing funding of HK$100,000 and mentoring to implement project.

Eligibility: This Programme welcomes students and graduates of local higher education institutions to apply as individuals or in teams.

-

Fast Forward

Theme: A structured 3-month programme to support early stage social enterprises seeking to grow and scale their impact on poverty alleviation in Hong Kong.

Eligibility: The programme is looking for social enterprises that:

- Support poverty alleviation through one or more of the following means:

a. Providing jobs for the disadvantaged, disabled and/or elderly

b. Enabling employment by removing barriers e.g. through vocational training or employment matching models

c. Providing products and services that reduce the cost of living for low-income households (e.g. low cost food, utilities, housing etc.) - Have at least two full-time co-founders

- Have already launched their products/services/models or at least have prototypes of those products/services/models that would be ready within 6 months.

The Programme: The programme consists of diagnostic/facilitation workshops, mentoring, networks and pitch nights to provide participating social enterprises with access to potential investors.

*SOW (Asia) Foundation Limited completed its service as an intermediary of SIE Fund in August 2016.

-

Nurturing Social Minds

Theme: Visionary and resourceful social entrepreneurs can think out of the box and take calculated risks in creating new business models, market norms and customer experiences. Venture philanthropy takes philanthropic funding to a whole new level of accountability and results-orientation, giving investors alternative opportunities they seldom enjoy before.

Combining the merits of the two, this course is specially designed for students with a vision in innovative, sustainable and impactful social businesses.

Eligibility: MBA students and undergraduates

3. Protect your company’s invention by securing your IP rights with the Patent Application Grant

Intellectual property (IP) is a core asset of every business and has the potential to become one of the most valuable assets of your business when managed properly. Under the Patent Application Grant, the Innovation and Technology Commission with Hong Kong Productivity Council (HKPC) assists local companies and individuals to apply for patents of their own inventions. It is a Government support for small business. All applications for functional patents and inventions with technological elements and industrial application are eligible. Under this grant, a company can receive a grant of up to HK$250,000 or 90% of the sum of the total direct cost of the patent application and the administration fee charged by the HKPC, whichever is lower.

What is its objective?

The Grant aims to encourage local companies and inventors to capitalise their intellectual work through patent registration.

Who are eligible to apply?

- All locally incorporated companies, Hong Kong permanent residents or Hong Kong residents permitted to remain in Hong Kong for not less than 7 years which/who have never owned any patents in any countries or territories before will be eligible.

- For individual applicant, the applicant must be the sole inventor or one of the joint inventors of the invention.

- For applicant company, the inventor(s) of the invention shall be a directly related party/parties to the applicant company, e.g. owner, shareholder, director, or staff. As the PAG is for first-time patent seekers only, funding support will not be provided if PAG has been granted to the applicant company’s related companies (i.e. (1) company(ies) having a major shareholder (viz. those with 50% or more ownership) in common with the applicant company or (2) company(ies) without major shareholder(s) but having shareholders identical to those of the applicant company) before.

How will the applications be processed?

Applications will be processed through the implementation agent on a confidentialbasis. Applicants must provide the implementation agent with details of their idea or inventions. A patent search-cum-technical assessment will be required. Based on the result of the patent search-cum-technical assessment conducted by the implementation agent, the Innovation and Technology Commission will decide whether the applications should be approved. The Commission’s decision will be final.

4. Fight economic downturns with the SME Loan Guarantee Scheme (SGS)

Afraid that your business has got everything going for it only to be badly hit by the next economic downturn? This is a valid concern, given that SME loan applications fell by 37% in the first half of 2016 amidst the economic slowdown. The government has helpfully put together various resources and funding schemes to support SMEs in exactly this type of scenario. It is a part of SME funding in Hk by government.

One of these funding schemes, the SME Loan Guarantee Scheme (SGS) provides loan guarantee to SMEs to aid them in securing loans from participating lending institutions (PLIs), which includes commercial banks, for acquiring business equipment or meeting general working capital needs. Under the scheme, the government provides a guarantee to the PLIs so that they can lend money to SMEs which do not have sufficient assets to secure bank loans. Small and medium business can take advantage from Government small business loan guarantee scheme.

Objective

The SME Loan Guarantee Scheme (SGS) provides loan guarantee to small and medium enterprises (SMEs) to help them secure loans from the participating lending institutions (PLIs) for acquiring business installations and equipment or meeting working capital needs of general business uses.

Eligibility

Enterprises(1) which meet the following criteria are eligible to apply for Government small business loan guarantee scheme:

- registered under the Business Registration Ordinance (Cap. 310) and with substantive business operation(2) in Hong Kong;

- an SME(3) under the definition of the Government of Hong Kong Special Administrative Region;

- not an associate of the lender; and

- not carrying on the business of a lender.

Note

(1) Enterprises

“Enterprise” refers to a legal entity which is engaged in any form of business for the purpose of gain. Non-profit-making or non-profit-distributing organisations are not eligible.

(2) Substantive Business Operation

To be eligible for the SGS, an enterprise should have substantive business operation in Hong Kong. A business holding a shell business registration or having most of its main business operation outside Hong Kong will not be regarded as having substantive local business operation.

For details about the requirement, please refer to the “Guidelines on the requirement of “substantive business operation”” issued by the TID.

(3) SME

An SME is a manufacturing business which employs fewer than 100 persons in Hong Kong; or a non-manufacturing business which employs fewer than 50 persons in Hong Kong.

“Number of persons employed” shall include proprietors/partners/shareholders actively engaged in the work of the business, and all salaried employees of the enterprise at the time of submitting applications. Such employees, including full-time or part-time salaried personnel, both permanent and temporary, must be directly paid by the enterprise.

5. Expand your business into markets abroad with the SME Export Marketing Fund (EMF)

The SME Export Marketing Fund (EMF) provides financial assistance to SMEs participating in export promotion activities in order to encourage SMEs to expand their markets beyond Hong Kong. For each grant that covers one export promotion activity, your business can get up to 50% of the total approved expenditure incurred or $50,000, whichever is less. Each business may receive up to $200,000 of EMF grants altogether, and there is no limit on the number of applications each business can submit.

Objective

The SME Export Marketing Fund (EMF) aims to encourage small and medium enterprises (SMEs) to expand their markets outside Hong Kong by providing financial assistance to SMEs for participation in export promotion activities.

Eligibility

An enterprise1 applying for a grant under EMF must fulfil the following requirements:

- It must be registered in Hong Kong under the Business Registration Ordinance (Cap. 310).

- It must meet the Government’s definition of an SME, i.e. if it is engaged in manufacturing business, it must employ fewer than 100 persons2 in Hong Kong; and if it is engaged in non-manufacturing business, it must employ fewer than 50 persons in Hong Kong.

- It must have substantive business operations in Hong Kong at the time of making the application. An enterprise holding a shell business registration or having its main business operation outside Hong Kong will not be regarded as having substantive business operations in Hong Kong.

- If it has previously received EMF grants, the cumulative amount of grants received must not exceed the prevailing cumulative grant ceiling. Applicant enterprises which have similar business registration details (e.g. nature of business, address, contact numbers, shareholder/directorship) will be treated as connected enterprises. For the purpose of the cumulative grant ceiling, connected enterprises are treated as if they are one enterprise, i.e. the cumulative amount of grants received by the connected enterprises concerned are aggregated and must not exceed the cumulative grant ceiling.

- It must not be the organiser/co-organiser/service provider or a related company of the organiser/co-organiser/service provider of the export promotion activity covered by the application.

Trade and Industry Department (TID) reserves at all times the absolute right to determine the eligibility of an enterprise applying for EMF grants.

Do you tap on any government grants for small business that are missing from this list?

Let us know in the comments below!

Updated List of Schemes in light of Covid-19 can be found here!

Alex Tanglao

Alex Tanglao is a seasoned professional with expertise in startups, legal technology, and business management. Alex has held leadership roles, including Director of Strategy & Operations at Elevate Digital, where he streamlined operations and managed teams, and Director of Ecommerce at Allies of Skin, driving global growth. Alex served as Marketing Manager at Zegal, driving legaltech and educating businesses on startup legal topics. With a background in content strategy from LawPath, Alex combines a deep understanding of legal services with operational excellence and innovative marketing strategies to help businesses thrive in dynamic, fast-paced environments.