Table of Contents

You may have heard the term bandied around but what exactly is IR35? And why should I care? Well, if you are self-employed, or employ contractors of any sort, you are definitely going to need to invest some time investigating this term. In recent times, the gig economy is amplifying the grey area that divides consultants from employees. Specifically, Great Britain has brought in IR35 to put a clear mark between the two.

At its core, the IR35 legislation is there for contract workers who operate as a limited company. For those working for a third party to provide specialist services to a client. It determines one as ‘outside IR35’ for these reasons, in addition to the stipulations that contractors do not receive benefits, holidays, or sick pay.

Why does the UK need IR35 legislation?

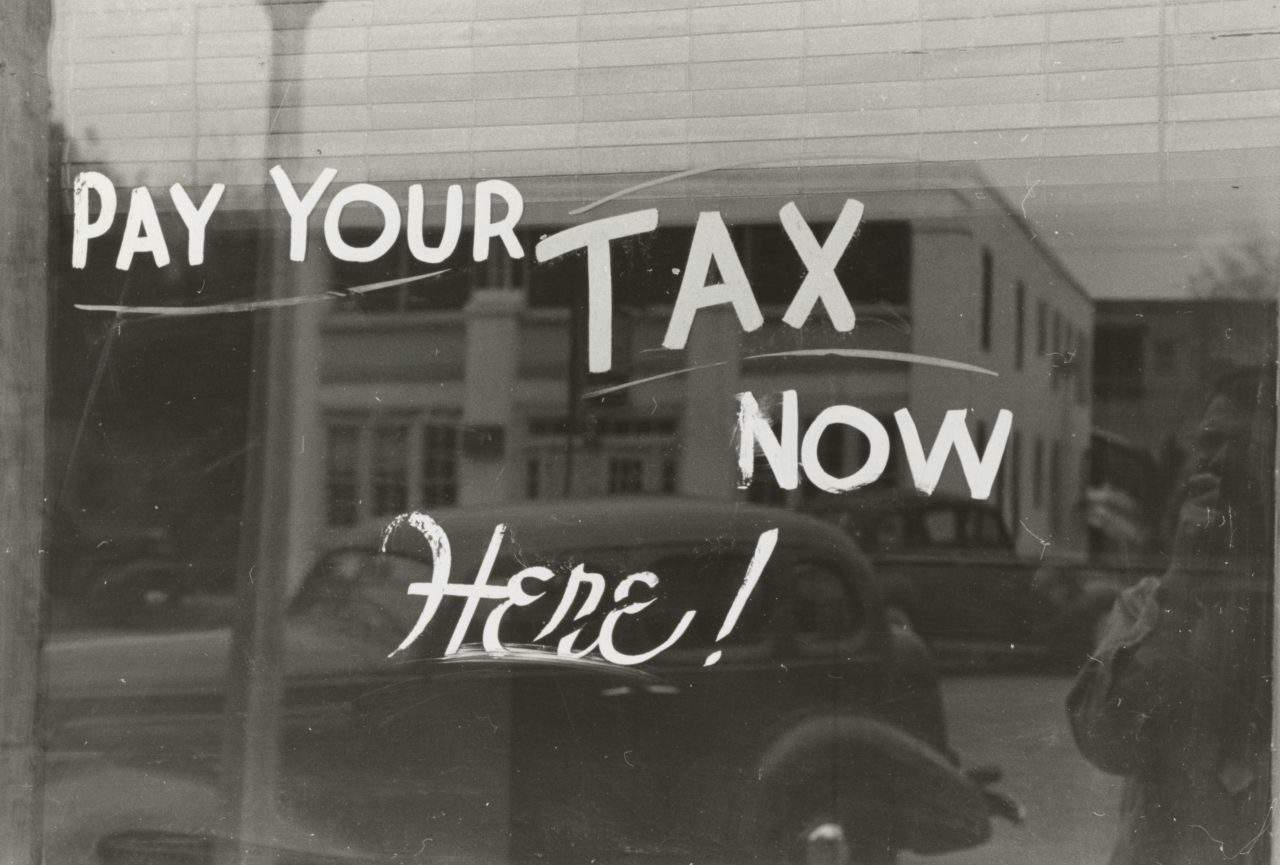

In general, the creation of the legislation was to stamp out the practice of companies having ‘disguised employees’ on their books in order to avoid tax. Contractors were often misusing the tax efficiency of a self-employment status, when in fact, their status should be as an employee. This became common as the gig economy opened these loopholes in the way we work. This is the government’s way of catching up with the changing world of work.

Why you should care about IR35

In addition to the legislation, HMRC is actively investigating individuals and companies to determine if a consultant’s status is correctly ‘outside IR35’. If not, the new rules demand that any money an employer hasn’t paid in national insurance be rectified. Also, missed tax and interest on the tax need to be paid. That’s not to mention the penalties for misclassifying yourself, which can be enormous.

For clarification, HMRC has developed an online employment status tool (CEST) for contractors unsure of their liability under IR35. If you are receiving the same rights as that of a permanent employee, for example, holiday entitlement, sick pay, or if you are receiving certain benefits, you will likely be deemed as inside IR35. We have a handy article here on determining whether you are inside or outside IR35.

Conclusion

This isn’t something you want to get wrong. Taxes are not an area you want to mess around with. Get your status properly assessed so you can get on with business.

Check out our IR35 checklist to make sure you have everything in order.

This article does not constitute legal advice.

The opinions expressed in the column above represent the author’s own.

BECOME A ZEGAL REFERRAL PARTNER

ABOUT ZEGAL

Zegal is the end-to-end platform for the legals smaller companies need.

Our story

Zegal was founded in 2014 by lawyer friends Daniel Walker and Jake Fisch. Having been a part of the system that preserves quality legal advice only for those that can afford it, the two were determined to build a model that delivers the ‘corporate law firm’ experience to small business.

Today Zegal is the world’s only end-to-end platform for smaller companies to create, negotiate, and sign both the simple, and complex contracts they need to run their business, with expert legal advice, 100% online every step of the way. Since our launch, we have helped more than 20,000 companies close commercial contracts, run leaner HR teams, and enter new markets. You can use Zegal for your company in the UK, Australia and across Asia. Make your legals simple.

READ MORE: UK Startups: Essential Legal Documents

READ MORE: New April 2020 tax rules in UK and how to comply with IR35

Alicia Walker

Alicia Walker is a deeply experienced professional editor, having been writing, editing, and creating content for leading publications and digital businesses across all corners of the globe. Alicia has held positions as lead editor for multiple publications across a range of industries including luxury, lifestyle, business, legal, entrepreneurship, and F&B.