Alex Tanglao

Alex Tanglao is a seasoned professional with expertise in startups, legal technology, and business management. Alex has held leadership roles, including Director of Strategy & Operations at Elevate Digital, where he streamlined operations and managed teams, and Director of Ecommerce at Allies of Skin, driving global growth. Alex served as Marketing Manager at Zegal, driving legaltech and educating businesses on startup legal topics. With a background in content strategy from LawPath, Alex combines a deep understanding of legal services with operational excellence and innovative marketing strategies to help businesses thrive in dynamic, fast-paced environments.

Need any help? Contact us:

Table of Contents

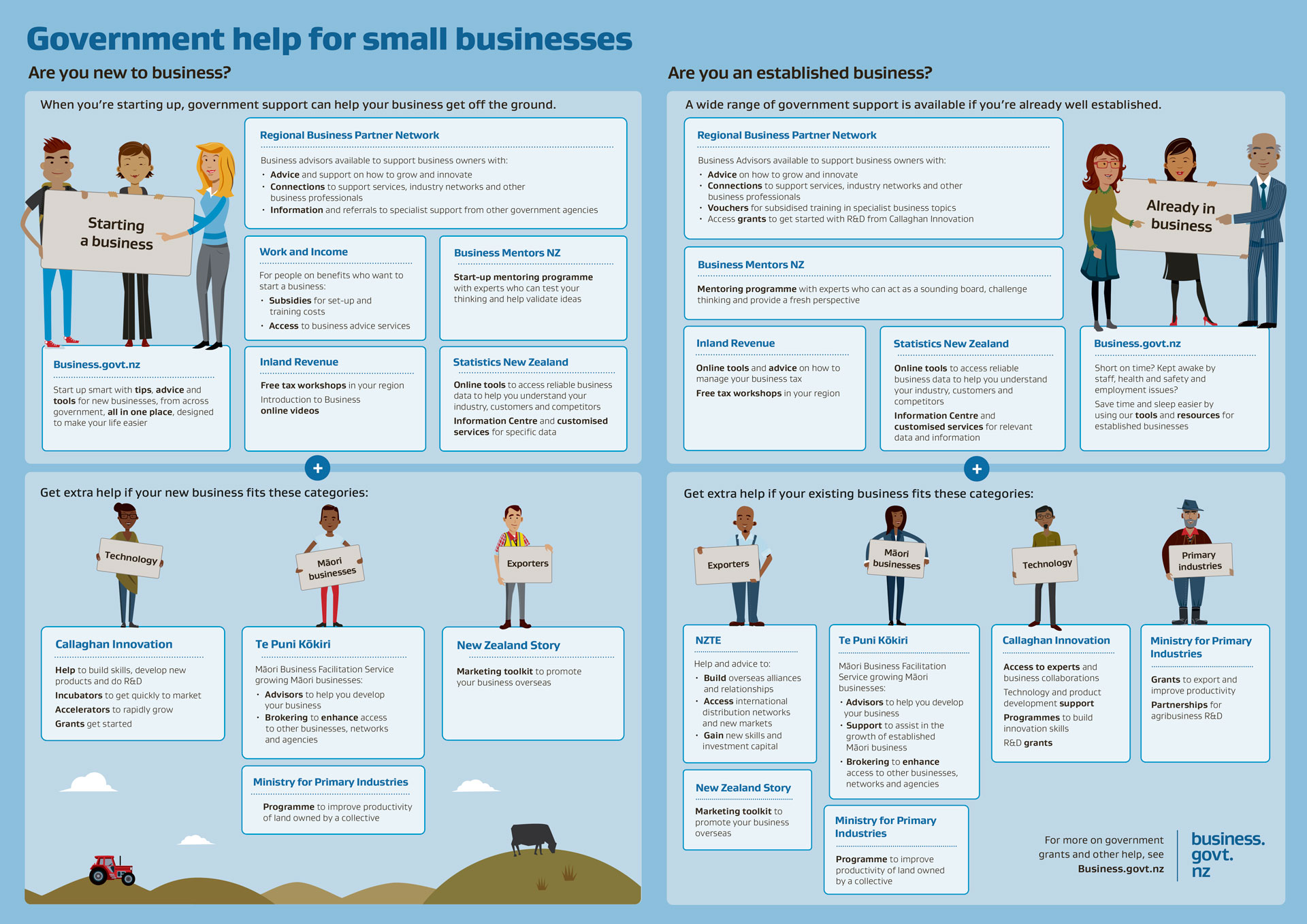

Ranked fifth in Forbes’ Best Countries for Business in 2018, New Zealand is an appealing destination for doing a business. Regardless of whether you are a new business or an established business, there is a range of government resources and support available for business owners. The New Zealand government also has grants for small business.

Source: NZTE

Here, we pick out the 5 government grants for startup businesses that you should check out to see if you qualify:

1. Business Training and Advice Grant

Numerous entrepreneurs have written about how finding great mentors has been crucial to the success of their business. Finding experienced and trustworthy mentors gives entrepreneurs the opportunity to tap on collective experience in making decisions and building their company.

If you are starting up your own business, the Business Training and Advice Grant connects people getting government assistance who want to start up their own business with the training and advice they need to start their business. It’s a business start up grants by New Zealand Government

How You can get Business Training and Advice Grant ?

You may be able to get a Business Training and Advice Grant if:

-

- either:

- you or your partner are getting a main benefit, or

- you qualify and have applied for a main benefit

- you’re getting New Zealand Superannuation or a Veteran’s Pension as a non-qualified partner

- you’ve asked Business Training and Advice Grant for help to start your business

- you’re planning to take up, or are already getting, Flexi-wage for self-employment for the same business.

- either:

What you can get from Business Training and Advice Grant?

Business Training and Advice Grant will pay an expert who will help you with things like:

- business skills training

- developing a business plan

- business advice before and when starting your business

- independent vetting report

- mid-project financial report.

You can apply more than once, but the total amount cannot be more than $1,000 in a 52 week period.

How to apply?

You can Call on 0800 559 009 and Business Training and Advice Grant will book you an appointment to come You will also need to write a brief summary about your business and provide information about what course or service you want the grant for.

-

Callaghan Innovation-Access to Expert

If you are a startup that wants to connect with mentors and business advice, Callaghan Innovation can help you to connect with the right advisor, partner or mentor as business grants in New Zealand.

Callaghan Innovation identifies the expertise in your field and helps to use business owners to have national and international networks of Callaghan Innovation which is government grant for business.

So one can take advantage from Callaghan Innovation partners to grow their idea.The main goal is to connect business owners with the right advisor, partner, mentor or technology provider.

Learn more about the access to experts available to startups.

2. Capability Development Vouchers

Administered by New Zealand Trade & Enterprise (NZTE), the Capability Development Vouchers can be used to co-fund up to 50% of capability development training up to a maximum of $5,000 per year per business, with the requirement that the business pays at least half of the training costs.Capability Development Vouchers is business funding grants in New Zealand

The vouchers can be used for training in business planning, capital raising, exporting, intellectual property and more.

In order to qualify for the NZTE Capability Voucher Scheme, the business must meet the following criteria:

- Have undergone an assessment with a Regional Business Partner

- have fewer than 50 full time equivalent employees

- are registered for GST in New Zealand

- are operating in a commercial environment

- privately owned businesses, or are a Maori Trust or incorporation under the Te Ture Whenua Maori Act 1993 or similar organisation managing Maori assets under multiple ownership.

If you are good with this criteria then you are eligible to meet RBP Growth Advisors to access co-funding for registered training enterprises. Here another steps you need to follow

- To access this co-funding you must first meet with one of our RBP Growth Advisors to discuss your business.

- The Growth Advisor will seek to understand opportunities for growth and help identify any barriers to this

- The Growth Advisor will then work with you to put together an action plan. Where there is a management capability need identified that could be addressed by undertaking training, the Growth Advisor may issue a Capability Voucher to the businesses.

Resource : Regional Business Partners

3. R&D grants

Research & development (R&D) is crucial to the development of any business as it provides a platform for innovation within an organisation and ensures that the business is constantly striving to maintain its competitive edge. Government agency Callaghan Innovation administers a range of R&D grants in New Zealand , in order to help businesses push the boundaries of scientific and technical knowledge in order to improve their products and processes.

There are a range of nz government business grants which target companies at various stages of R&D investment, including:

Source: R&D Grants

Getting Started Grants

The Getting Started Grant is designed to help you:

- Launch your R&D activities to create a competitive edge

- Navigate through R&D roadblocks – whether its troubleshooting, basic prototyping, project planning, technical feasibility studies, development of an Intellectual Property strategy or determining product specifications and user requirements

- Access technical expertise to support you in taking your development in the right direction.

Project Grants

The Project Grant is designed to help you:

- Build your R&D expertise by giving your business an opportunity to push the boundaries and uncover new scientific or technical knowledge and understanding

- Break new ground in an R&D project for the development of new or substantially improved devices, products, processes, systems or services

- Develop your business into a stable and substantial R&D performer

- Grow your investment in R&D.

Growth Grants

The Growth Grant is designed to help you:

- Add scale to your R&D investment for greater market impact

- Be flexible by allowing you to adapt to where you want to take your R&D programme, outside the constraints of traditional R&D grant criteria

- Continue to grow your investment in R&D for maximum return

Students Grants

Student Grants designed to support both businesses and students.

Source: Callaghan Innovation

4. Flexi-Wage Subsidy

Introduced in 2012 to target those most at risk of remaining on welfare, the Flexi-Wage Subsidy helps businesses hire someone on benefit as an employee and may also help with the training costs.

Individuals who are self-employed may also be eligible for Flexi-Wage. Small businesses have reported that the Flexi-Wage Subsidy has allowed them to take on new employees who require training as it helps to alleviate the costs of the training during the period when the new hire is not yet making a profit for the business.

In order to be eligible for the Flexi-Wage programme, you must be currently receiving some form of government benefit or payment, as well as a citizen or permanent resident of New Zealand. To find out whether your business qualifies for the Flexi-Wage programme, speak to a case manager at Work and Income.

How to get Flexi-wage Subsidy?

You may be able to get Flexi-wage for an employee if:

- they’re one of our candidates

- they meet the criteria for Flexi-wage

- the position is ongoing and will continue after the subsidy has finished

- you pay at least the minimum wage for the job

- you haven’t dismissed anyone else just to employ them.

Who can get Flexi-wage Subsidy

Ministry of Social development discuss with you how much we can offer and how it’s paid. This will depend on what help the candidate needs to reach the skill level for the job.

Application Process

If Ministry of Social development find a suitable candidate for you but they require extra support, they will l contact you to discuss how Flexi-wage can help. They will need to check that you and the candidate meet the criteria for Flexi-wage.

If you choose to employ the candidate, They will organise the application for Flexi-wage.

As part of this, they’ll:

- contact you to discuss and agree on a:

- development plan for them

- subsidy amount

- payment structure

- draft up a contract outlining these details and if it’s approved, they’ll contact you to let you know and discuss next steps.

they’ll email you the contract before your candidate starts work. You need to complete the contract and email it back to us along with evidence of your bank account number.

You’ll be paid once the contract has been processed.

5. Energy Management Support

If your product manufacturing processes form a significant part of your costs, you may want to consider the energy management support that the Energy Efficiency and Conservation Authority (EECA) provides, including partnering with a custom energy management software development company to optimize your energy.

The EECA will fund up to 40% (to a maximum of $100,000) of the cost of expert help to bring energy saving practices into your company as government grants for startup businesses in New Zealand. By developing an energy management plan comprising an energy-savings target and a system to manage your energy, you can significantly cut operational costs and make your business more profitable.

Energy management support is designed to fund a specific, step-by-step process. This is managed by EECA’s experienced partners, who’ll help you to:

- set an energy-savings target

- commit to energy management, with a team and ‘energy champions’

- set up a system to manage your energy, including having an energy policy

- identify your main areas of energy use

- create plans to prioritise energy-saving opportunities.

Who can apply ?

Energy management plans are ideal for large businesses with complex energy requirements. But smaller businesses can also benefit from long-term energy management planning.

If you spend over $200,000 per year on energy, you may be eligible for funding support.

Learn about energy management support.

Claim your free trial. Start drafting legal documents with Zegal today.