Table of Contents

Recent research conducted by McKinsey & Company indicated a rising number of joint ventures (JVs) across the globe. It also shows that executives reported they had a positive experience with joint ventures – more than 75% of these JVs met their expectations. It stands to reason that joint ventures represent a high chance of achieving set goals.

Joint ventures are slowly overshadowing alternatives like M&A (merger and acquisition), and are becoming the go-to strategy for business expansion and development. Joint ventures come with both risks and rewards for all parties involved, but to enjoy the latter, you must be familiar with the different types of JVs, how partnerships are formed/ended, and the legal paperwork that needs to support the process.

What is a Joint Venture?

A joint venture refers to two or more businesses uniting their skills and resources to achieve the set goals. The reasons behind this endeavour vary from case to case but, most commonly, the focus is on:

- More prosperous business development;

- Easier production of new products or expansion of service offering;

- Tapping into new markets.

DOCUMENT: Joint Venture Agreement

Benefits of Joint Ventures

Regardless of the industry, the competition is harsh and no one’s success is guaranteed – while startups and SMBs struggle to build their name in the market, enterprises fight to keep their dominance. In recent years, joint ventures became a solid strategy to achieve business goals a company (of any size) sets.

Broadly speaking, a joint venture helps to increase the number of resources and capacity, boost expertise, and gain better access to established markets and distribution channels.

Risks of Joint Ventures

Poor communication between the parties forming the joint venture can have negative consequences. First off, goals need to be clearly defined – more often than not, the partners who form a JV have different objectives and don’t share them with each other, which affects the overall focus and can even lead to none of the goals being achieved.

Secondly, the imbalance of expertise or the number of resources brought about by the JV partners can affect the strength of the relationship and mutual respect.

In situations where the parties are from different cultures or have different management styles, the venture may suffer consequences due to poor cooperation and integration.

What is more, partners may not offer sufficient support or leadership skills and affinities, thus reducing the chances of the joint venture’s successful development.

Types of Joint Ventures

Now that we’ve examined the negative possibilities, let’s look at the benefits that may come with forming a JV and the different types. Firstly, it is imperative to define the goals you wish to achieve with the venture. This will affect your decision on the type of venture you wish to establish:

- Limited co-operation with another business in an effort to improve your product distribution or service offering by accessing new distribution channels or reaching new markets. In such a case, it is key to sign a contract which sets out the boundaries, and terms and conditions of the collaboration.

- A separate joint venture can be formed in addition to the companies involved in a JV. It’s a flexible option in which JV partners own shares of the newly-established company and sign an agreement outlining the details of the methods of its management.

- A business partnership where the two or more businesses merge to work towards achieving the set objectives.

There are several legal documents that can be easily drafted to define the goals, business structure, operation tactics, parties’ responsibilities, and general terms and conditions.

Legal Paperwork

Before drafting an official venture agreement, the parties may decide to compose two additional documents:

- A confidentiality agreement to protect any confidential information that will be disclosed between the parties involved in the joint venture during the discussions and negotiation. An NDA is a legally binding contract by which a party receiving information from another party agrees to keep such information confidential.

- Heads of terms document (or Memorandum of Understanding) should be drafted as well, as it contains the key joint venture principles that will not be negotiable in the future. It represents a legally non-binding document that summarises the results of negotiations between two parties in order to facilitate the future formation of a contract.

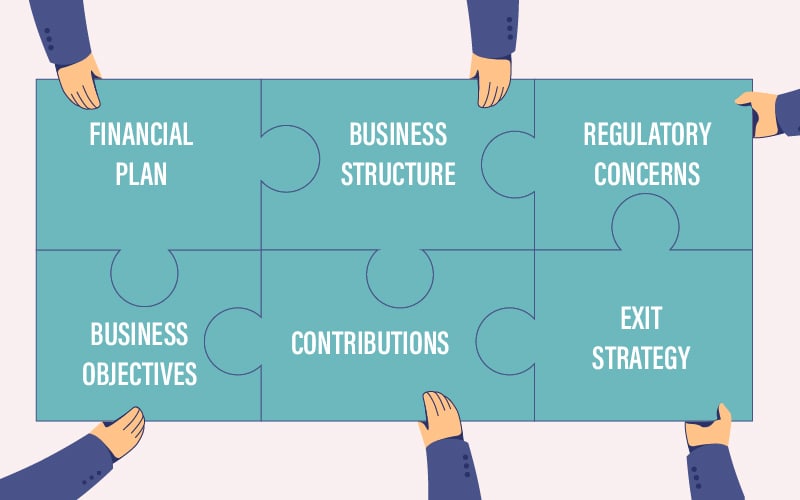

Joint Venture Agreement: An Outline

The joint venture agreement is necessary to strengthen the bond between the parties and to secure their individual benefits.

Objectives

It is not uncommon for joint venture partners to skip the most crucial step of the process – establishing the goals of the JV. Often parties may focus on their individual goals, which can ultimately do more damage than good. The two or more businesses involved in the venture should lay out the objectives and a clear-cut business plan which will act as a solid foundation for the upcoming endeavour.

Structure

If objectives are less complex and do not require additional expenses, a joint venture is established without setting up a new, separate entity – the parties simply agree to work towards an objective they have agreed on.

Alternatively, a separate entity can be established and all parties involved in the venture would own it. In this case, a decision has to be made regarding the type of venture – do you wish to form a corporation, a partnership, a limited partnership, or a limited liability company? The final choice will be made based on the complexity of the venture, the limitations, target markets, taxes, exit strategy, etc.

Regulatory Concerns

Joint ventures are subject to a number of regulatory issues, which is why the agreement should mention the following:

- Target marketplace(s). Industry regulations vary depending on the market and a joint venture needs to familiarise with the specific regulations of all markets it intends to target. Furthermore, if you plan on establishing a cross-border joint venture, consider any country-specific regulations which might limit the venture’s operations.

- Employment. Employment laws differ from one market to another and they have to be taken into consideration when hiring staff, no matter if they are to be employed full-time, part-time, or as independent contractors.

- Taxes. Taxation issues are the key factor in defining the corporate structure of the venture.

Contributions

Joint ventures are formed among parties which see benefits from the symbiosis because each of the parties can contribute with a unique set of activities and resources other parties cannot provide. The agreement should specify how the individual parties involved in the joint venture are contributing – will they offer financial support, intellectual property (IP), real estate, services, or “know-how”? Each asset should be valued to avoid any potential issues down the road when the time comes to get paid out by the joint venture.

Control and Management

In the case when all parties are equal owners of the venture, it is essential to define governance. A multitude of variables intervene and some of the most important questions that need to be answered within the joint venture agreement are:

- How will the hiring process work?

- How often will the board meetings be held?

- Which types of reports should be delivered and how frequently?

- How will the disputes be managed?

- If there are minority owners – which items will require ‘the majority vote’ to approve?

- If there are dividends – how will the parties get paid out?

Financial Concerns

The joint venture partners need to agree on the specific means of financing, as well as the allocation of revenue. Funds are a delicate matter and should be discussed early on to avoid any future arguments that may result from misunderstanding.

Exit Strategy

One of the most important clauses of the agreement sets out the plan for how the venture will end or how one or more parties can exit. The following considerations need to be accounted for:

- Is there an official event or date defined for the end of the venture?

- Can any of the parties terminate the relationship past a certain date?

- How will the IP be unbundled?

- How will the confidential information be protected upon all or any of the parties exit?

- How will future income be distributed?

- Who will be responsible for any continuing liabilities?

- Can a party sell their shares to a third party or another venture partner (who in that case could become the majority owner)?

- Do other parties have the right to refusal?

- What if any of the parties fails to fulfil its obligations?

Above are some of the potential scenarios – since it is difficult to predict all possible situations, business professionals are advised to consult with their legal professional to cover as many bases as possible.

Are You Ready?

Choosing to participate in a new joint venture foundation will make significant changes to your business. Prior to making any final decision, be sure to review your business strategy, analyse the goals, evaluate your venture partners, and discuss the nature of the relationship and joint objectives.

Trust is the building block of any partnership, and in business – it needs to be cemented with a solid legal contract. It will enlist go-to solutions should any disagreements or issues arise. As such, it will keep all parties on the right track, working towards the same goals intended to maximise their business performance.

Start managing your legal needs with Zegal today

READ MORE:

Legal Documents you might need as a Business Partnership

Strictly Confidential? You need a Non-Disclosure Agreement

How a Memorandum of Understanding (MoU) can help your business

Top 5 Australian government grants for small businesses you should know about