Straight off the bat:

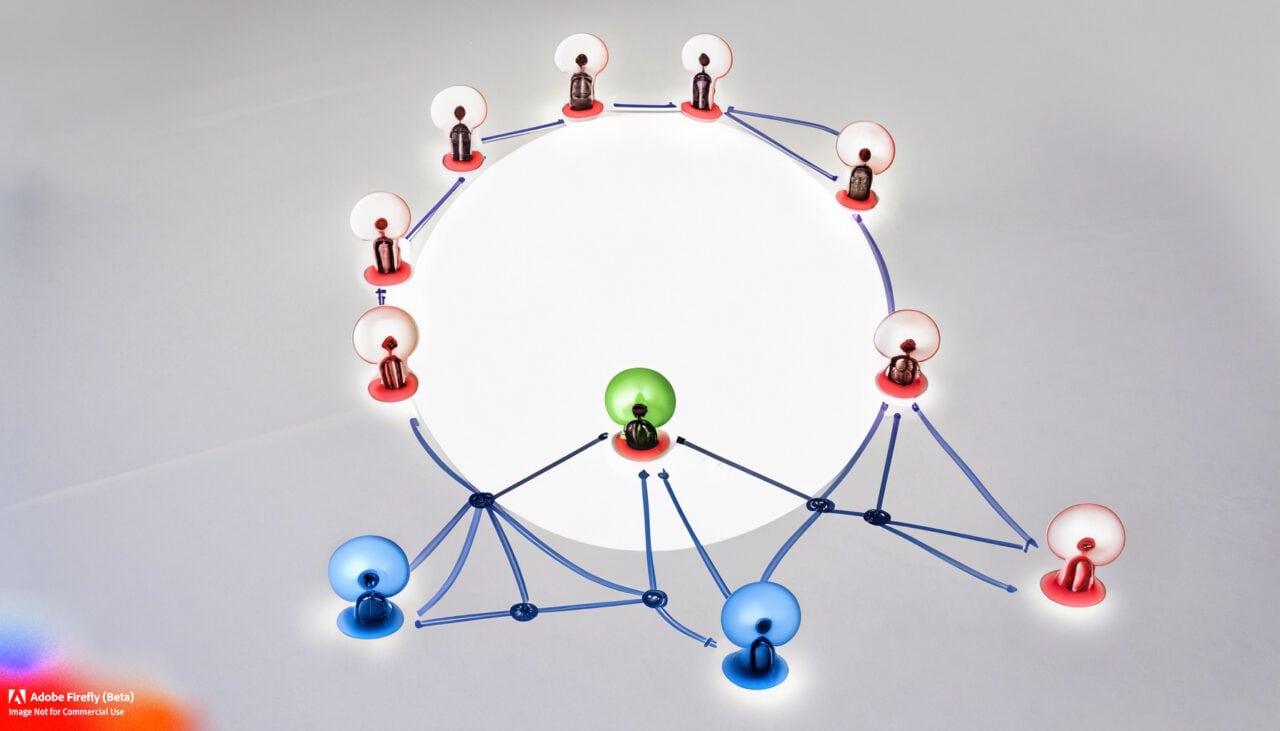

A subsidiary is a company which is fully-owned or partially controlled by another company.

The other company is referred to as the parent company or the holding company. The subsidiary is said to belong to the parent company as it has a controlling interest in it.

Where a subsidiary is 100% owned by the parent company, it is said to be wholy owned. Conversly, holding at least 51% of shares also conveys a controlling interest.

Why do companies form subsidiaries?

Here are some practical examples of reasons to setup a holding company/subsidiary relationship:

Recognition of Brand

To keep the brand identities separate, the company may establish subsidiaries. This helps all the brands to maintain their relationship with the vendors and the goodwill with the customers. By keeping separate brand entities, it is easy to organize the culture of the company and differentiate different brand entities.

To raise capital

By having the ownership of a subsidiary company, the parent company can offer shares for their percentage of the its company and drive investments. Using this way, the money can be raised by the parent company without incurring the risk of altering or changing the stock value of the parent company.

Financial Considerations

The consolidated tax return can be filed by the parent company which owns at least 80% of shares in one or more of the subsidiaries. This also allows the parent company to write off the losses incurred by their total income. Because each subsidiaries has its own business, the parent company can sell the unprofitable subsidiaries without having any effect on its parent company. As a result of separate business, the creditors of a subsidiary company can only sue the subsidiaries who has entered into a contract with them.

Reporting and strategic disclosure

In case of separate business of the parent company from its subsidiaries, it allows the parent company to choose which aspects of the business should be public or remain private. This is generally helpful in case of a parent company in a competitive industry and not willing to introduce a new product line.

Advatanges and disadvantages of a subsidiary stucture?

Advantages of subsidiaries:

-

Tax benefits of a subsidiary

It helps the parent company to substantially reduce its tax liability using deductions allowed by the state. Where there are multiple subsidiaries of a parent company, the profit made by one of it-can be offset against the losses by the other company.

- Reduction of risk with a subsidiary

As discussed, it is a separate and distinct legal entity which mitigates the risk. There is no transfer of losses of its to the parent company. However, in case of bankruptcy, where it can be proved that the parent and subsidiary company are legally and effectively the same, the obligations of it may be assigned to the parent company. - Increased efficiency and diversification through a subsidiary

Creating subsidiaries allows the parent company to achieve greater efficiency by dividing a large company into smaller parts and more effectively managed companies.

Disadvantages of subsdiaries

- Limited control of subsidiaries

Where this company is not wholly owned by the parent company which means it is partially owned by some other company, the parent company may have management control issues with its subsidiary company. In fact, the decision making will also be difficult because the problems must be decided through a proper chain of command within the parent company structure before any action is taken place. - Legal costs of establishing subsidiaries

Additional legal paperwork and management can amonut to a significant cost and puts a burden both for the establishment of it and in filing taxes.

What are the attributes of a subsidiary?

A subsidiary is a separate and distinct entity or corporation from its parent or holding company. It can sue and be sued in its own name and separately from its parent or holding company. This company has its own liabilities and obligations and the parent company is not liable for its subsidiaries.

As mentioned above, the parent company should have at least 51% of shares in the subsidiary company to have an ownership over it. The percentage of ownership will give the parent company a right to exercise control in the decision making of the company.

It is not necessary for the parent and the subsidiary company to have business at the same location. Also, it is not necessary for both the parent and subsidiary company to have business in the same line. It is also possible for it to have its own subsidiary companies. In that case, the subsidiary company will act as a parent company for its subsidiary company.

What are examples of subsidiary companies?

- In the digital industry, one of the most popular examples is Facebook. It has many subsidiaries as it has multiple investments in other companies and acts as a parent company for those subsidiaries. In 2012, Facebook acquired social media application Instagram. In 2014, it also acquired a popular messaging application, Whatsapp and bought shares of the virtual reality company, Oculus.

- Google restructured in 2015 and formed Alphabet as the holding company above its different subsidiaries such as Google & Nest.

- Tata Consultancy Services is a subsidiary of TATA Group

- Jio is of Reliance Group.

- Motorola, as acquired by Lenovo.

How do subsidiaries work?

Subsidiaries are setup to provide the two companies with sufficient separation yet specific synergies. Such synergies come in the form of tax benefits, risk diversification, assets in the form of earnings, property or equipment. Though these are established by the parent company, the subsidiaries are separate and distinct from the parent company.

This means that the subsidiary company is liable in its own name, it has its own taxation and governance. Where the subsidiary company is established or owned by the parent company in a foreign jurisdiction, the law of the country where the subsidiary is incorporated and operates will apply.

The parent company has a controlling interest in the subsidiary company and exercises considerable influence over their subsidiaries. The board of directors of it are elected by the parent company along with the other shareholders of the subsidiary.

There is a difference between the purchase of an interest in the subsidiary and a merger. There is a smaller investment by the parent company in case of purchase and there is no requirement to get approval from the shareholders to turn a company into its event of a merger. Nor is a vote required to sell it.

In order to become a subsidiary, at least 51% of shares must be held by the parent company. Where the percentage of shares is less than this, it will not be called a subsidiary, instead it will be an associate or affiliate company. When it comes to financial reporting, an associate is treated differently.

Is a franchise a subsidiary?

A subsidiary relationship goes deeper than a franchise arrangement and may include capital share, influence over managing staff, and generally a greater level of control that the parent company exerts on the subsidiary company. This control varies from company to company.

On the other hand, the franchise model focuses on business practices and intellectual property rights like trademarks, copyrights or trade secrets to the franchisee. During the existence of the franchise agreement, the IP rights are granted by the franchisor to the franchisee.

You Might Also Like:

Along with this document, make sure you see these other templates in our library: