Need any help? Contact us:

Table of Contents

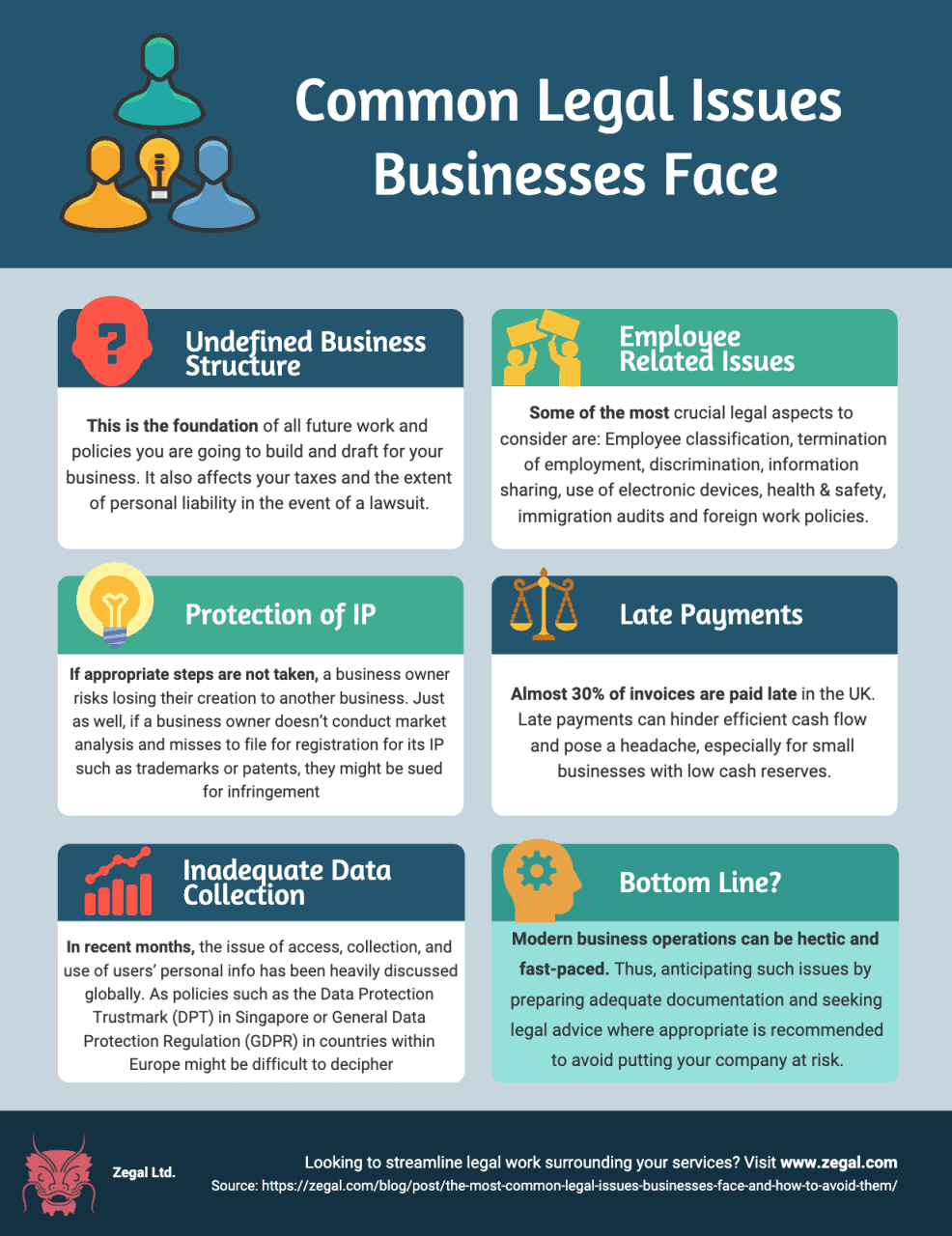

The high cost of legal services is one of the main reasons why small business owners evade hiring legal representation until it is almost too late. However, there are other ways to prevent costly and lengthy legal disputes.

In the early days, small businesses may find it difficult to set aside an already limited budget for the services that might not seem of immediate importance. However, taking into account the all too common legal issues a business might experience, protecting your business from legal problems should be prioritised in your budget.

While there are issues that are industry-specific and vary depending on the business model, here are a list of certain legal matters that the majority of entrepreneurs face, regardless of the type of business they are running and how to protect your business against them.

Undefined Business Structure

Defining company structure is the foundation of all future work and policies you are going to build and draft for your business. It also affects your taxes and the extent of personal liability in the event of a lawsuit. Thus, the first decision revolves around registering your company as one of the following:

- Sole proprietorship – A business owner runs a company on their own, without setting up a legal entity. They are in complete control and while they collect all the profits, a sole person is also the main responsible for all liabilities and taxes.

- Partnership – A company established between two or more individuals who share the profits and are both responsible for all liabilities. In that case, the two parties should draft a Partnership Agreement that states the details of the partnership, capital shares among them, limitations, obligations, and restrictions of the partners. It is possible to end the partnership and change the business structure. In that case, it is best to sign a Dissolution of Partnership Deed and make the termination of the initial Partnership Agreement official.

- C Corporation – A company viewed as an independent legal entity which is independent of its owners who are only responsible for the investments they made.

- S Corporation – A company that comes with more appealing tax benefits in comparison to C Corporation. Income and losses pass through shareholders and are included on their individual tax returns.

- Limited Liability Company – A company which is not taxed as a separate business entity. Its profits are passed through each of its members and owners have limited liability and specific regulations which vary from one state to the other. It requires signing LLC Agreement which outlines the functional and financial decision-making rights.

Employee-related Issues

As legal policies keep updating on a regular basis, employers are challenged to keep up. Some of the most crucial legal aspects to consider are:

Employee Classification

To establish a legally binding contract with a newly employed worker, it is imperative to define their status: are they employed full-time, part-time, or as independent contractors? This will affect the terms of the Employment Contract which sets out provisions on different aspects of employment like job details and specific employee entitlements such as a certain list of benefits, paid overtime, and minimum wage.

- Full-time vs part-time

The difference between a part-time and full-time employee is usually made based on a number of work hours, which differs depending on the state, but usually ranges between 35 and 40 hours per week. In the UK, full-time entails at least 35 hours of work per week. In Australia, it boils down to 38 hours a week, while in the U.S., ACA defines more than 30 work hours a week as full-time employment. Furthermore, part-time employees are usually paid by the hour and are not entitled to the same benefits as full-time employees, unless it is otherwise defined by the Employment Contract.

- Casual employment

In Australia, a casual worker is paid hourly and they lack common full-time benefits like sick leave. They are contacted when the regular workforce needs to be supplemented, but a casual employee is allowed to refuse the opportunity to work.

In New Zealand, they are granted annual leave or holiday pay, but not sick leave. The work hours are not guaranteed and are irregular as casual employees are only contacted when the need arises.

In the UK, casual employees work occasionally for a specific business and are allowed to refuse the work opportunity. Still, they have to agree to the company’s terms and conditions and are under a manager’s supervision.

In Hong Kong, casual employees are remunerated daily and are included in the Mandatory Provident Fund (meaning they are included in the pension plan).

In Singapore, casual employees are hired on an ad-hoc basis and the contract only lasts for a specified period.

- Independent contractor

An independent contractor is defined as a third party that runs its own business, hiring out services to other organisations. Typically, independent contractors negotiate fees and specific working arrangements and are able to offer their services to different clients simultaneously. They are not entitled to benefits such as annual or sick leave and are responsible for paying their own taxes.

Termination of Employment

Letting go of an underperforming employee can raise legal issues if an employer mishandles the situation. It may result in a wrongful termination lawsuit or an administrative hearing.

Generally speaking, reasons for rightful Employment Contract termination can include employee:

- Underperformance

- Misconduct

- Retrenchment/redundancy

Employers are obliged to draft a Notice of Termination and provide an adequate notice period which depends on the amount of time the employee in question has spent working at the company. Instant dismissal is only possible in cases when an employee has conducted theft, fraud, assault, or has refused to carry out reasonable instructions.

To prepare for contract termination and avoid unlawful dismissal of an employee, company mission and expectations in terms of performance, employee and client treatment need to be clearly stated. Comprehensive terms of employment should be listed in the Employment Agreement.

Discrimination

Former, current or just prospective employees can sue on the grounds of discrimination related to firing, hiring or working in a hostile work environment. Discrimination allegations can be based on gender, ethnicity, or age, and only through regular meetings can a manager detect whether there is discrimination or harassment on a smaller scale in a company (among employees).

It is an employer’s job to promote a healthy work culture and environment that encourages diversity. To ensure that the company offers equal employment opportunity for prospective candidates, drafting an Equal Opportunities and Anti-harassment Policy will ensure all employees refrain from any behaviour that might be considered discriminatory.

Note that there two types of discrimination exist:

- Direct when one person is treated less favourably due to their age, race, descent, colour, ethnic or national origin, marital status, (potential) pregnancy, immigrant status, disabilities, or family responsibilities.

- Indirect means applying a particular practice to all employees but, as a result, showing the lack of fairness towards a specific group of people associated with any of the above-listed attributes.

Information Sharing

During discussions with prospective business partners, contractors or employees you may share confidential information about how you conduct your business. Making them sign a Confidentiality Agreement (or NDA) can help you protect your business secrets. A Confidentiality Agreement is a legally-binding contract which ensures the parties who sign it keep certain information enlisted within the contract confidential.

Once you have decided to hire an employee or independent contractor, you can include a corresponding confidentiality clause in the respective Employment Contract or Consultancy Agreement for example.

To find out more about the use of a Confidentiality Agreement, read our extensive article on NDA.

Use of Electronic Devices

If all, or some, of your employees use their own electronic devices at work, outlining a BYOD Policy is recommended to ensure the company’s network security. While these are pretty common in today’s professional ecosystem where the majority of employees own and prefer using their own devices at work, there are both pros and cons worth considering prior to implementing a BYOD Policy.

On the one hand, an employer is likely to see increased productivity among employees who use devices of their preference. In addition, the costs of investing in company equipment are going to be lower. On the other, the security of confidential data is put into question, as the employees will access sensitive information on their personal devices.

READ MORE:The Lowdown On BYOD Policies

Health & Safety

If the job involves hard physical work and use of special equipment, the employer must ensure the work environment follows health and safety rules and guidelines. Workplace injuries are common and, when they occur, employees involved in the accident may decide to sue the company for damages.

To ensure the company is committed to workplace safety and health, it is necessary for an employer to draft a Health and Safety Policy where they will clearly state the company’s responsibilities and procedures that are followed to prevent injuries and illnesses.

Immigration Audits

Although skilled overseas employees are always welcome to contribute to any company’s operations, it is imperative for all to have the appropriate work visa required to apply for work in a particular country.

In Australia, there are three subclasses of visa available for prospect overseas employees: Subclass 188, Subclass 888, and Subclass 132. As stated by PwC, compliance with immigration law, in general, is taken seriously, and employers should have regard to ensuring that people they employ have the correct authorisation.

When it comes to the UK, their immigration system is quite restrictive. Note that in the last decade they have made a number of adjustments to the system, and additional ones are expected as a result of Brexit. Considering, an employer should always consult with an informed legal advisor who will help determine whether a prospective worker is truly eligible.

In Singapore, it is interesting to note that the region heavily insists on improving the skills of its local workforce. Although Singaporean business owners welcome unique immigrant talent, the government has taken steps to address the issues that arise with a large influx of immigrants. Some restrictions have been imposed on hiring foreign talent which created a shortage of manpower. However, a recent decision to grant letters of consent instead of work pass to foreign spouses has lessened the issue. With the help of a corporate legal professional, it is simpler to define whether a particular candidate is eligible for the position or not.

Foreign Work Policies

If you are looking to outsource a part of your operations to another country, it is imperative to seek a legal professional who will help you familiarise and understand the contracts, policies and procedures in place in that foreign jurisdiction entity. Specific employment policies and procedures, including health, BYOD, data protection and other policies can be significantly different. Understanding them could be crucial for your upcoming expansion to the new marketplace.

Protection of Intellectual Property

Intellectual property (IP) refers to creations protected in law by patents, trademarks, and copyright, enabling its creators to earn recognition and financial benefits from it. If appropriate steps are not taken, a business owner may risk losing its creation to another business.

Just as well, if a business owner doesn’t conduct market analysis and misses to file for registration for its IP such as trademarks or patents, they might be sued for infringement by another business or an individual who believes (and possesses sufficient proof) of unauthorised similarity to their product or company name, logo, tag line, or a product name.

Legal disputes related to IP can take years, and small businesses run the risk of losing when hunted by larger corporations with a more significant budget and greater legal team.

FURTHER READING: Good Business Idea? How To Protect It Through Intellectual Property Rights

Late payments

Statistics indicate that, in the UK, almost 30% of invoices are paid late. How can a company pursue clients and encourage on-time payments? Through a collection lawsuit or by sending ‘Past Due’ notices.

Here’s some points on drafting official documentation as a proof of the client’s breach of contract:

- Establish clear payment terms and have them signed by a customer. This will serve as official evidence that the client was aware of the requirements in advance.

- When the client is late, sent out First Payment Reminder Letter as a friendly reminder of their financial obligations.

- In case the payment is not processed after the first reminder, draft a Second Payment Reminder Letter as a follow-up reminder to repay outstanding debt.

- Draft a Final Payment Reminder Letter that briefly explains the client’s financial obligations and a final payment deadline.

RELATED READING: 5 Must-Have Legal Documents for Cash Flow Optimisation

Inadequate Data Collection

If you plan on opening offices in Europe or want to offer your products/services to any European countries, you are required to rewrite your Privacy Policy to comply with GDPR. It outlines the rules regarding how companies collect and share personal data, that way protecting online users who do not want to share their personal information. To gain access to any kind of user data, you will have to ask for consent first.

Similarly, Singapore has established its Data Protection Trustmark (DPTM) scheme which assures consumers’ personal data is properly handled. Although it is only a pilot project, recent events have shed light on the importance of the protection of private information.

In recent months, the issue of access, collection, and use of users’ personal info has been heavily discussed globally. As the above and similar policies might be difficult to decipher, it is better to hire a legal advisor who will go through all the points and clarify the changes your business needs to implement to comply with all listed rules and regulations.

Bottom Line

Modern business operations can be hectic and fast-paced, and can as such bring about legal chaos if proper documentation is not drafted to prevent from the most common legal issues. Thus, anticipating such issues by preparing adequate documentation and seeking legal advice where appropriate is recommended to avoid any lawsuits that put your company at risk.

With Zegal, you can streamline all legal work surrounding your business. The online platform stores all documents and contracts, and also serves as a collaboration hub where legal professionals and clients can negotiate, draft, and sign contracts. Resorting to a digital solution as Zegal makes the completion of legal work more efficient, it contextualises legal advice and benefits transparency. For a business owner, this means they will better familiarise with their legal obligations and it will be easier for them to meet all legal requirements.

This article does not constitute legal advice

Start managing your legal needs with Zegal today

READ MORE: The Startup Documents Your Business Cannot Live Without: A Complete Legal Toolkit

READ MORE: Business Insights For Leaders In Asia: How To Run a Meeting Like a Boss